Happy Tuesday. This is Electric Avenue, your friendly neighborhood e-mobility newsletter. We bring you cold, refreshing EV news like the milkman brought milk back in the day. Just read along and pair us with a bowl of cereal in the morning 🥛 🥣.

Here’s what we have for you today:

From 3 to 300 - the growth of US charging networks 📊

3 Links 🔗

Meme of the week 🤡

Not subscribed yet? Sign up here 👇🏼

Let's dive in!

From 3 to 300 - the growth of US charging networks 📊

BlloombergNEF, Ecomovement

In a recent article, BloombergNEF & Eco-Movement published some interesting stats which we wanted to share with y’all. It shows a comparison of the growth of ultra-fast charging connectors for EVs in the US and Europe from Q1 2021 through Q3 2023. Key take-aways from the graphs:

🔌 Europe is far ahead in this race, with a significantly higher number of ultra-fast charging connectors compared to the US.

In the US, Tesla’s is the by far the largest fast charging network with a steady increase in connectors over time. The next five biggest operators show a more modest growth - no wonder Ford, GM & Co are keen to access Tesla’s network.

Europe 🇪🇺 has a mind-boggling 500 separate companies that are building public ultra-fast charging stations. Tesla's presence is still significant but not as dominant as in the US. Meanwhile the next five biggest operators in Europe show significant growth and have recently caught up to Tesla in terms of connectors across the continent. The category labeled "Others" exhibits the highest growth, indicating a competitive market with lots of regional players.

3 thoughts 💭:

The electric vehicle charging sector in Europe is not just more expansive but also fiercely competitive, showcasing a broad spectrum of firms pouring investments into infrastructure. This confirms our view that Europe’s public charging ecosystem is ahead of the US by a couple of years.

We expect to see a similar development in the US in the next years with increasing non-Tesla EV sales, the standardization around NACS and funding programs like NEVI providing incentives for new players to enter the market. In particular, we expect retailers, gas station operators and fast-food chains to switch from just beeing site hosts to operating their own branded charging networks (see our article from April 2023 ⚡ Goodbye gas station 👋 - The Evolution of Retailer charging 🛒).

Finally, efficient acquisition of high-quality charging sites will be crucial for market share and profit, as shown in Ole's guest post "⚡ What does it take for a Charge Point Operator to be profitable?". Having an “unfair advantage” in access to attractive sites will enable certain new players (e.g. Walmart) to quickly gain a substantial market presence. This was demonstrated by the rapid expansion of Aral Pulse, a gas station operator and subsidiary of BP, in Germany. (see below for a nice visual by Schnellladepark.App.)

3 Links 🔗

Turning up the volume 🔊: Back in June we reported that Canadian startup dcbel had secured a strategic investment by Volvo Cars (Link). The company’s “r16”, a bidirectional DC charger + home energy manager functions as a shared inverter for DC-coupled solar systems, energy storage as well as V2G and V2H charging for emergency backup power. Now we have a confirmation that this investment led to an actual collaboration between the companies: Alexander Petrofski, VP of Volvo Cars Energy Solutions, confirmed that Volvo’s EX90 electric SUV will be compatible with dcbel r16 for bidirectional charging.

Stable Auto, Dynamic pricing 📈: US-based Stable Auto offers a suite of tools that helps charging networks select the best sites and operate them profitably. The company just launched it’s newest product, an algorithm that dynamically prices chargers in real-time based on current energy costs, nearby competition, and local demand from EV drivers.

HERE we go⚡: Last week we made a tongue-in-cheek comment about Tesla basically setting the feature roadmap for Product teams at other OEMs and companies involved in Trip Planning. Case and point: Navigation provider HERE just announced a major update to its EV product (Link). The enhancement titled “EV range factors” takes into account a large number of additional factors (e.g. predictive wind speed and direction, ambient temperature) to improve range predictions.

Most-clicked link last week: was this video about Tesla’s industry-leading EV trip planning (Link)

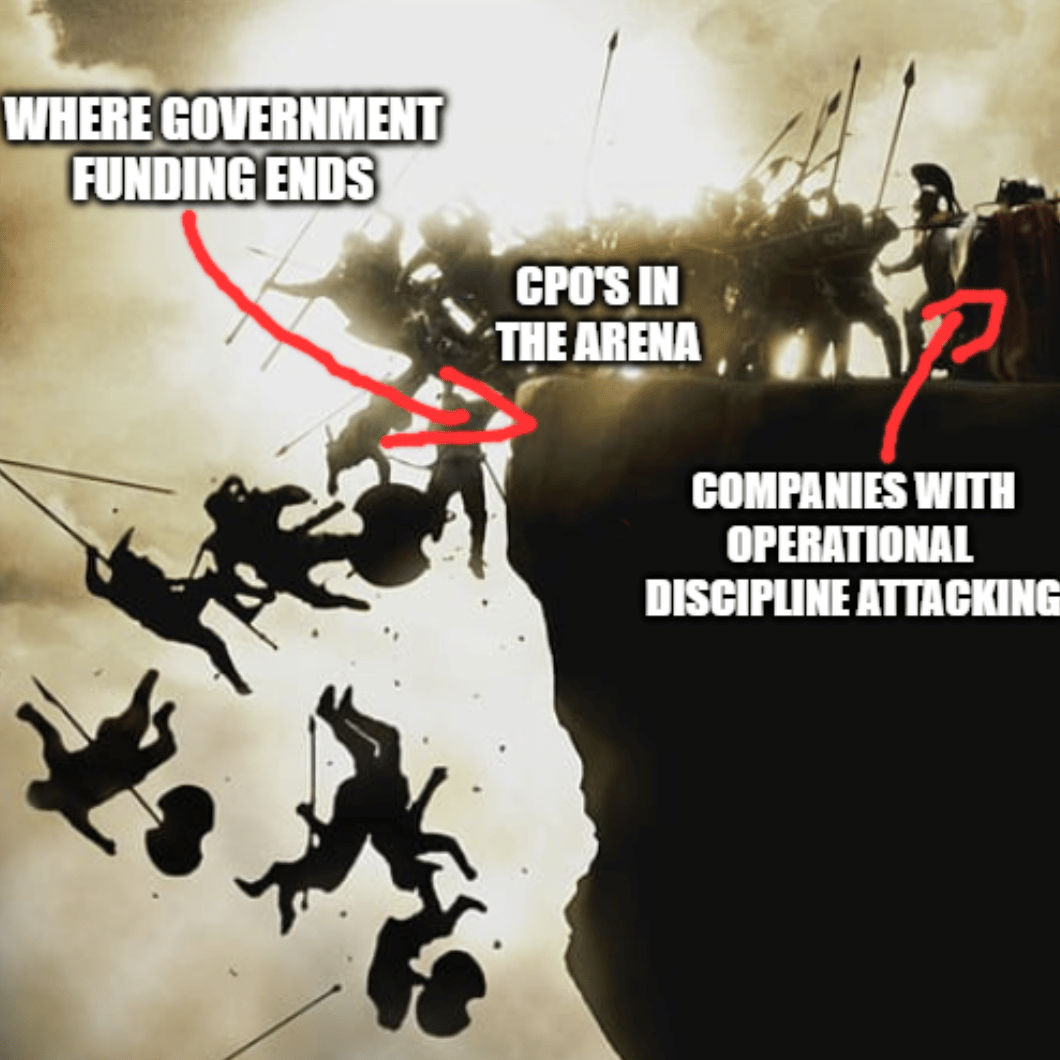

Memes of the Week 🤡

🤣🤣🤣

That's a wrap for this week! Let us know how you feel and leave some feedback (We read every single one of these 🙂 ):

Reader Review of the Week

Selected ⚡️⚡️⚡️⚡️⚡️ Freakin´ awesome on⚡ EV Trip Planning Masterclass 📖 and wrote:

“great feature on #EV trip planning and how seamless Tesla and Tesla Charging makes it”

What do you think of today´s edition?

Someone forwarded this to you? Subscribe now - it's free!

DISCLAIMER: None of this is financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. The Electric Avenue team may hold investments in or may otherwise be affiliated with the companies discussed.